You are here:iutback shop > trade

What Determines the Price of a Bitcoin?

iutback shop2024-09-21 05:32:42【trade】6people have watched

Introductioncrypto,coin,price,block,usd,today trading view,The cryptocurrency market has been experiencing rapid growth over the past few years, with Bitcoin b airdrop,dex,cex,markets,trade value chart,buy,The cryptocurrency market has been experiencing rapid growth over the past few years, with Bitcoin b

The cryptocurrency market has been experiencing rapid growth over the past few years, with Bitcoin being the most prominent digital currency. As the price of Bitcoin fluctuates, many individuals and investors are curious about the factors that influence its value. In this article, we will explore what determines the price of a Bitcoin.

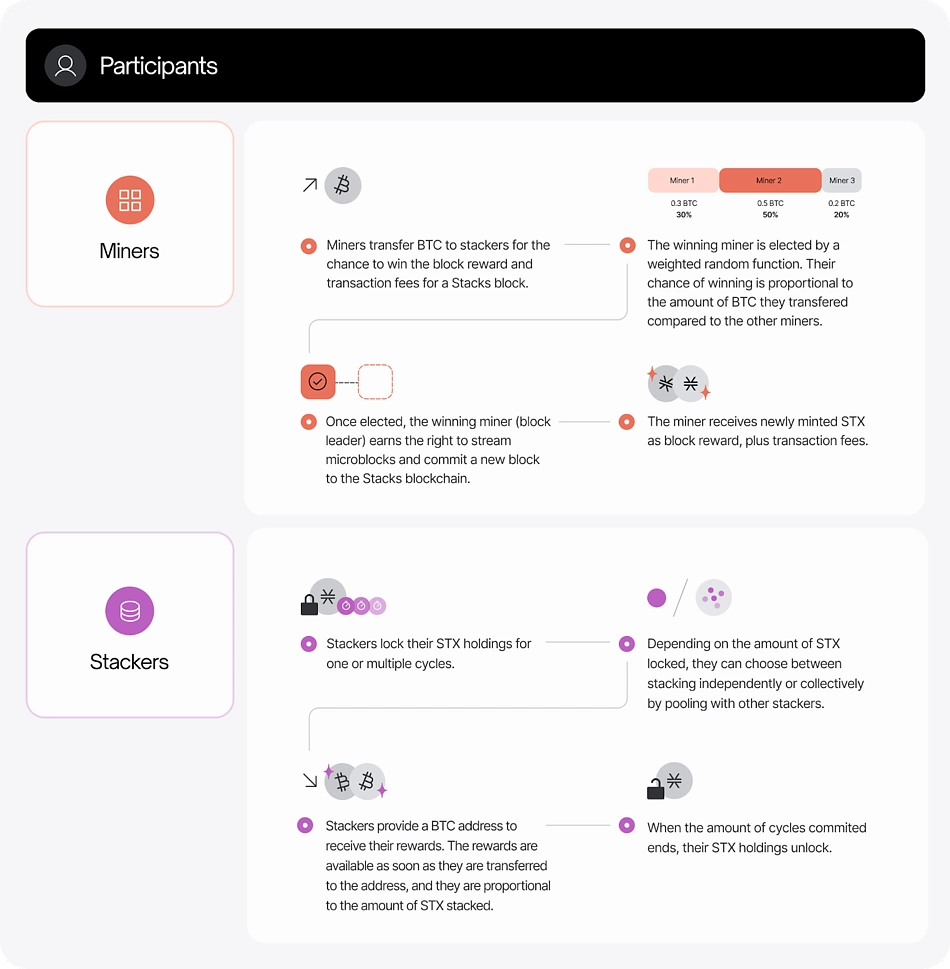

Firstly, supply and demand play a crucial role in determining the price of a Bitcoin. The supply of Bitcoin is limited, as there is a maximum of 21 million coins that can be mined. This scarcity makes Bitcoin a valuable asset, as the demand for it continues to rise. When demand for Bitcoin increases, its price tends to rise, and vice versa. Additionally, the supply of Bitcoin is controlled by a predetermined algorithm, which ensures that new coins are created at a consistent rate.

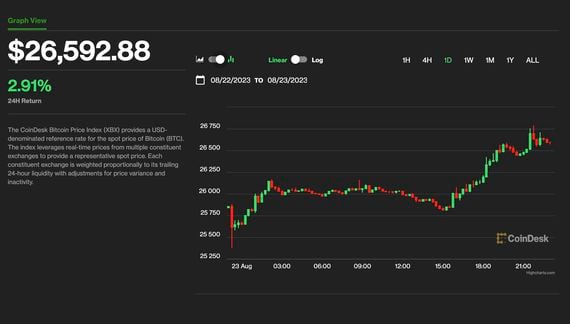

Secondly, the market sentiment and investor psychology also contribute to the price of a Bitcoin. The cryptocurrency market is highly speculative, and investors' emotions can significantly impact its value. For instance, during the 2017 bull run, Bitcoin's price skyrocketed due to the overwhelming optimism and speculation among investors. Conversely, during the 2018 bear market, Bitcoin's price plummeted due to widespread fear and uncertainty. Therefore, understanding the sentiment of the market and the psychology of investors is essential in determining the price of a Bitcoin.

Thirdly, regulatory factors play a significant role in the price of a Bitcoin. Governments and regulatory bodies around the world have varying stances on cryptocurrencies, which can affect their adoption and, subsequently, their value. For example, countries like China and India have imposed strict regulations on Bitcoin, which has led to a decrease in its price in those regions. On the other hand, countries like Japan and South Korea have embraced cryptocurrencies, leading to an increase in their adoption and, consequently, their value.

Moreover, technological advancements and innovations in the cryptocurrency space can impact the price of a Bitcoin. For instance, the development of new blockchain technologies, such as the Ethereum network, has sparked interest in cryptocurrencies and, in turn, increased the demand for Bitcoin. Additionally, the success of initial coin offerings (ICOs) and decentralized finance (DeFi) projects has also contributed to the rise in Bitcoin's price.

Another factor that determines the price of a Bitcoin is the correlation with traditional financial markets. Many investors view Bitcoin as a hedge against inflation and economic uncertainty, similar to gold. As a result, during times of economic turmoil, Bitcoin's price tends to rise due to increased demand for safe-haven assets. Conversely, when the stock market is performing well, Bitcoin's price may decline as investors shift their focus to traditional assets.

Lastly, media coverage and public perception also play a role in determining the price of a Bitcoin. The cryptocurrency market is highly sensitive to news and events, as they can quickly sway investor sentiment. For example, when Bitcoin was first introduced, it was met with skepticism by many. However, as more people became aware of its potential, its price started to rise. Therefore, the media's portrayal of Bitcoin and the general public's perception of it can significantly impact its value.

In conclusion, the price of a Bitcoin is influenced by various factors, including supply and demand, market sentiment, regulatory factors, technological advancements, correlation with traditional financial markets, and media coverage. Understanding these factors can help investors make informed decisions and predict the future price of Bitcoin. However, it is important to remember that the cryptocurrency market is highly volatile, and predicting its price remains a challenging task.

This article address:https://www.iutback.com/blog/77f53299390.html

Like!(49)

Related Posts

- Bitcoin Price is Going Up: What You Need to Know

- Accessing Your Binance Wallet: A Comprehensive Guide

- Bitcoin Price Prediction This Week: What to Expect in the Cryptocurrency Market

- How to Get Bitcoin Address on Cash App: A Step-by-Step Guide

- Can I Buy Bitcoin in Brazil and Sell in US?

- Can You Buy FTM on Binance US?

- Bitcoin Mining Sverige: The Growing Trend in Sweden

- Why Binance Coin Went Up: A Comprehensive Analysis

- Bitcoin's Price in 2009: A Journey Through Time

- Can I Change Money to Bitcoin on Uphold?

Popular

Recent

How to Withdraw to Bank Account from Binance: A Step-by-Step Guide

Bitcoin Price is Going to Go Up: A Comprehensive Analysis

How to Get Bitcoin Address on Cash App: A Step-by-Step Guide

When Does Binance Resume Deposits and Withdrawals: A Comprehensive Guide

Bitcoin Mining with Tablet: A New Trend in Cryptocurrency

Best Bitcoin Wallet Indonesia: Your Ultimate Guide to Secure Cryptocurrency Storage

Binance to Cash App: A Seamless Gateway for Cryptocurrency Transactions

Bitcoin Mining Cashapp Scam: Unveiling the Deceptive Scheme

links

- Bitcoin Mining Using Blockchain: A Revolutionary Technology

- How to Get Bitcoins Without Mining

- Where to Sell Binance Coin: A Comprehensive Guide

- Can Bitcoin Price Fluctuate Downward?

- Best Bitcoin Wallet for Transactions: Ensuring Security and Efficiency

- Bitcoin Cash Electrum Send to Address Format: A Comprehensive Guide

- How Do I Deposit Bitcoin on Cash App?

- How Long Does It Take for a Bitcoin Transfer to Binance?

- The Rise of USDC Binance Chain: A Game-Changer in the Crypto World

- The Rise of USDC Binance Chain: A Game-Changer in the Crypto World